The report “Tax Battles” also highlights that the average corporate tax in countries around the world has dropped four points in 10 years.

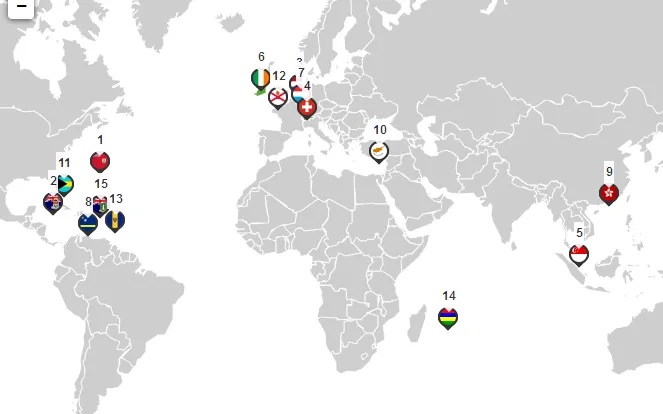

The report "Tax Battles: the dangerous global race to the bottom on corporate tax" published by Oxfam International highlights that 5 of the 15 most aggressive tax havens around the world are in Europe. The Netherlands, Switzerland, Ireland, Luxemburg and Cyprus, in this order, appear in the ranking prepared by the international organisation following a specific methodology based on three main points: the nominal corporate tax rate, tax incentives offered by Governments and the lack of commitment to international initiatives against tax evasion. This is the ranking of tax havens in Oxfam’s report:

1. Bermuda

2. Cayman Islands

3. The Netherlands

4. Switzerland

5. Singapore

6. Ireland

7. Luxembourg

8. Curacao (located in the Caribbean)

9. Hong Kong

10. Cyprus

11. Bahamas

12. Jersey

13. Barbados

14. Mauritius

15. The British Virgin Islands

Tax avoidance and evasion by corporations are at the origin of the inequality crisis, according to the report. Oxfam underlines that 62 people hold as much wealth as 3.6 billion people; that is half of the world’s poorest people. In this regard, a study carried out by the organisation found that 90% of the world’s largest corporations are present in at least one tax haven.

Another factor that was studied in the report is the “race to the bottom” that the authors refer to as “Fiscal wars”. In an attempt to attract investors, Governments from around the world have cut back the nominal corporate tax rates and have “drastically reduced the taxation of corporations so as to attract business”. At a global level, the average corporate tax rate has dropped from around 27.5% in 2006 to 23.6% today, meaning that the rate has dropped by four points in only 10 years. According to this report, the European Union and the G20 have agreed to draft a blacklist of tax havens so as to put an end to tax evasion and avoidance. But the EU, however, does not contemplate a 0% corporate tax rate as a criterion. This means the Bermudas, for instance, which are considered as the worst tax haven by Oxfam, would not be on the EU’s blacklist.

So as to reduce corporate tax evasion, Oxfam has gathered some recommendations on a global tax reform, tax havens, corporate tax, public transparency and large corporations. Among these measures it is worth emphasizing a greater commitment of Governments to tackle this downward trend, establishing a global fiscal organisation to coordinate international fiscal cooperation, and corporations being fiscally responsible beyond compliance with the law.

Add new comment