The latest report from the Stockholm International Peace Research Institute (SIPRI) indicates that the war in Ukraine has boosted U.S. arms sales between 2020 and 2024.

The Russian invasion of Ukraine in February 2022 and the war it triggered—still ongoing in the heart of Europe—have profoundly shaped global arms transfer trends. Conflicts like that in Ukraine fuel the arms trade and the global military industry, which is thriving in an increasingly turbulent world that seems to have embraced growing militarism and embarked on a dangerous path toward rearmament.

A clear example of this is the latest data published by the Stockholm International Peace Research Institute (SIPRI) on international arms transfers. The report, analyzing the period between 2020 and 2024 compared to the previous five-year period, highlights the enormous influence of the Ukraine war on the global arms trade. This explains why Ukraine has become the world's largest arms importer and why the United States (U.S.) has further strengthened its dominance in global arms exports.

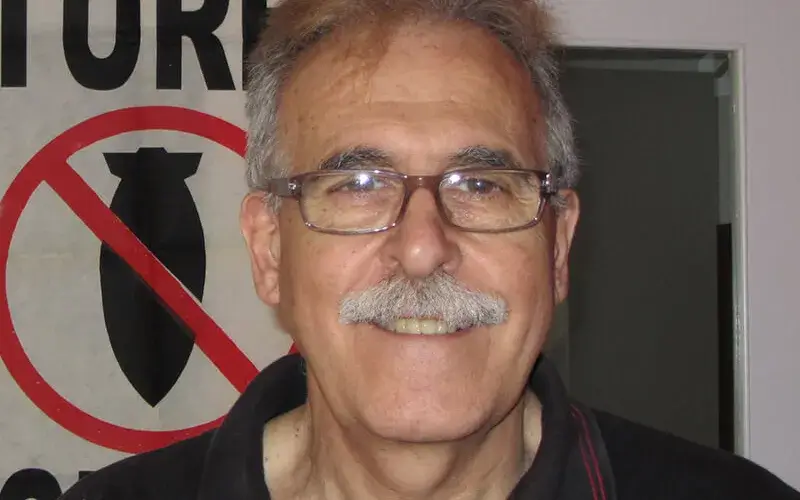

“It’s no surprise, but these SIPRI figures confirm that the war in Ukraine is shaping international arms transfer trends,” summarizes Albert Caramés, director of FundiPau, who also emphasizes that “Ukraine has solidified its position as the world's leading arms importer, multiplying its import volume during the 2020-2024 period compared to the previous five years.”

Looking at SIPRI’s data, Ukraine’s imports of heavy weaponry between 2020 and 2024 were nearly one hundred times higher than in the 2015-2019 period. Today, the country accounts for about 9% of global arms imports.

In fact, since Russia’s invasion in February 2022, at least thirty-five states have sent weapons to Ukraine. However, if there is one country that has particularly benefited from the conflict, it is undoubtedly the U.S., which remains by far Ukraine’s main arms supplier, accounting for 45% of its imports. It is followed, at a much greater distance, by Germany (12%) and Poland (11%).

A clear example of this is the latest data published by the Stockholm International Peace Research Institute (SIPRI) on international arms transfers. The report, analyzing the period between 2020 and 2024 compared to the previous five-year period, highlights the enormous influence of the Ukraine war on the global arms trade. This explains why Ukraine has become the world's largest arms importer and why the United States (U.S.) has further strengthened its dominance in global arms exports.

“It’s no surprise, but these SIPRI figures confirm that the war in Ukraine is shaping international arms transfer trends,” summarizes Albert Caramés, director of FundiPau, who also emphasizes that “Ukraine has solidified its position as the world's leading arms importer, multiplying its import volume during the 2020-2024 period compared to the previous five years.”

Looking at SIPRI’s data, Ukraine’s imports of heavy weaponry between 2020 and 2024 were nearly one hundred times higher than in the 2015-2019 period. Today, the country accounts for about 9% of global arms imports.

In fact, since Russia’s invasion in February 2022, at least thirty-five states have sent weapons to Ukraine. However, if there is one country that has particularly benefited from the conflict, it is undoubtedly the U.S., which remains by far Ukraine’s main arms supplier, accounting for 45% of its imports. It is followed, at a much greater distance, by Germany (12%) and Poland (11%).

The U.S. Strengthens Its Hegemony as Europe Prepares to Rearm

The U.S. dominance in supplying weapons to Ukraine has further cemented its global leadership in arms exports. “The U.S. holds a unique position in the arms trade,” states SIPRI, with a share of global exports four times larger than its closest competitor, France.

Between 2020 and 2024, U.S. global arms exports increased by 21% compared to the previous period. Its overall share in global exports rose from 35% to 43%. “This leading role has been reinforced by Ukraine’s dependence and that of many other countries on U.S. weaponry,” explains Albert Caramés.

One of the main U.S. clients in the last five years has been NATO’s European countries. During this period, these nations increased their arms imports by 155%, with 64% of those weapons coming from the U.S. For the first time in two decades, Europe has overtaken the Middle East as the main recipient of U.S. arms exports.

The significant increase in European arms purchases can be understood as a response to Russia’s invasion of Ukraine and uncertainty regarding U.S. foreign policy, especially after Donald Trump’s return to the White House.

Although European arms imports have surged by 105% and are expected to rise further in the coming years—given the continent’s renewed focus on rearmament and the €800 billion global defense spending plan—Ukraine remains the only European country among the world’s top ten arms importers in the last five years.

A key goal of this European rearmament plan is to reduce military dependence on Washington. However, as Caramés points out, “this dependence will continue for quite some time, as many arms contracts with the U.S. are still pending delivery.”

According to the FundiPau director, “the EU is pursuing a dual narrative: it seeks to establish its own defense identity through rearmament while still relying on U.S. arms imports for the foreseeable future. As a result, this rearmament strategy will not yield immediate results.”

Europe’s urgent push for rearmament is also a way to assert its position in response to the new Trump administration, which has made it clear that NATO members failing to increase their defense spending will not be viewed favorably.

As Caramés emphasizes, it will be crucial to monitor how these dynamics affect arms transfer trends in the coming years. Among other things, Europe’s new rearmament priorities and its need to appease the U.S. on defense spending will lead to changes, such as Spain classifying certain research expenditures as military spending that were previously categorized differently.

Russia’s Decline Paves the Way for France

The U.S. dominance in supplying weapons to Ukraine has further cemented its global leadership in arms exports. “The U.S. holds a unique position in the arms trade,” states SIPRI, with a share of global exports four times larger than its closest competitor, France.

Between 2020 and 2024, U.S. global arms exports increased by 21% compared to the previous period. Its overall share in global exports rose from 35% to 43%. “This leading role has been reinforced by Ukraine’s dependence and that of many other countries on U.S. weaponry,” explains Albert Caramés.

One of the main U.S. clients in the last five years has been NATO’s European countries. During this period, these nations increased their arms imports by 155%, with 64% of those weapons coming from the U.S. For the first time in two decades, Europe has overtaken the Middle East as the main recipient of U.S. arms exports.

The significant increase in European arms purchases can be understood as a response to Russia’s invasion of Ukraine and uncertainty regarding U.S. foreign policy, especially after Donald Trump’s return to the White House.

Although European arms imports have surged by 105% and are expected to rise further in the coming years—given the continent’s renewed focus on rearmament and the €800 billion global defense spending plan—Ukraine remains the only European country among the world’s top ten arms importers in the last five years.

A key goal of this European rearmament plan is to reduce military dependence on Washington. However, as Caramés points out, “this dependence will continue for quite some time, as many arms contracts with the U.S. are still pending delivery.”

According to the FundiPau director, “the EU is pursuing a dual narrative: it seeks to establish its own defense identity through rearmament while still relying on U.S. arms imports for the foreseeable future. As a result, this rearmament strategy will not yield immediate results.”

Europe’s urgent push for rearmament is also a way to assert its position in response to the new Trump administration, which has made it clear that NATO members failing to increase their defense spending will not be viewed favorably.

As Caramés emphasizes, it will be crucial to monitor how these dynamics affect arms transfer trends in the coming years. Among other things, Europe’s new rearmament priorities and its need to appease the U.S. on defense spending will lead to changes, such as Spain classifying certain research expenditures as military spending that were previously categorized differently.

Russia’s Decline Paves the Way for France

Another major revelation from the SIPRI report concerns Russia, which has experienced a sharp decline in arms exports between 2020 and 2024 compared to the previous five-year period. The research institute estimates a 64% drop in Russian arms exports, reducing its share of global arms trade from 21% to just 8%.

This decline is due to two main factors: First, Russia’s growing need to retain weaponry for use on the battlefield in Ukraine. Second, international sanctions, which have hindered arms production and sales while pressuring countries not to buy Russian weapons. “I would argue that the sanctions have had a greater impact than Russia’s internal arms use,” notes Caramés.

Despite this decline, Russia has sold weapons to 33 countries in the past five years, with India and China being its top clients.

Russia’s shrinking role in global arms exports has allowed France to overtake it as the world’s second-largest arms supplier between 2020 and 2024. France has exported weapons to 65 countries and has tripled its arms sales to European nations such as Greece, Croatia, and Ukraine. Notably, 6.5% of the total arms imported by NATO’s European countries now come from France.

Developments in Asia, the Middle East, and Africa

China has invested heavily in expanding its arms exports by developing its domestic military industry. However, it remains the fourth-largest global arms exporter, accounting for 5.9% of global arms sales. Political considerations have limited its expansion, as major importers tend to avoid purchasing Chinese weapons.

China’s arms imports also fell by 64% between 2020 and 2024, as the country increasingly relies on domestically produced weaponry. This shift has contributed to a decline in global arms transfers to the Asia-Oceania region, which dropped from 41% to 33%, though it remains the world’s largest arms-importing region.

India, the world’s second-largest arms importer—mainly sourcing weapons from Russia (36%)—continues to ramp up its military acquisitions due to perceived threats from China and Pakistan. Pakistan, in turn, has significantly increased its arms imports by 61% between 2020 and 2024 compared to the previous five years. China remains its dominant supplier, accounting for 81% of Pakistan’s arms imports.

The Middle East remains a highly volatile region, particularly due to Israel’s ongoing war in Gaza following Hamas’ attack on October 7, 2024. Despite the conflict, Israel’s arms imports remained stable between 2020 and 2024. The U.S. is Israel’s main arms supplier, providing 66% of its total imports, followed by Germany at 33%.

“Diplomatic ties between Israel, the U.S., and the EU remain strong, as does Israel’s role as a strategic partner in the arms industry,” notes Caramés. He stresses the importance of continuing to “speak out and condemn violations of arms embargoes against Israel, both in terms of imports and exports, as seen in cases like Spain.”

In West Africa, arms transfers have surged over the past 15 years due to worsening security conditions. Between 2010-2014 and 2020-2024, African states nearly doubled their arms imports, with an 82% increase. Nigeria was the region’s top importer, accounting for 34% of all arms acquisitions between 2020 and 2024. Meanwhile, arms imports in Sub-Saharan Africa rose by 4.2% during the same period.

Spain: The World’s Ninth-Largest Arms Exporter

The SIPRI report also highlights Spain, which ranks ninth globally in arms exports, holding a 3% share of the global market. Spain’s arms exports increased by 29% between 2020 and 2024 compared to the previous five-year period.

However, Caramés notes that Spain initially ranked as the world’s fifth-largest arms exporter at the start of this period but has gradually slipped down the rankings. By 2024, Spain had dropped to eleventh place.

“This isn’t necessarily a cause for celebration—it reflects the growing strength of competitors like China and France, which have outpaced Spain in the global arms market,” explains Caramés. He adds that it will be crucial to monitor how Spain is impacted by the EU’s €800 billion rearmament plan.

Regarding the destination of Spanish arms exports, Saudi Arabia remains the country’s most important market, accounting for 24% of Spain’s total arms exports, followed by Australia (18%) and Turkey (13%).

This decline is due to two main factors: First, Russia’s growing need to retain weaponry for use on the battlefield in Ukraine. Second, international sanctions, which have hindered arms production and sales while pressuring countries not to buy Russian weapons. “I would argue that the sanctions have had a greater impact than Russia’s internal arms use,” notes Caramés.

Despite this decline, Russia has sold weapons to 33 countries in the past five years, with India and China being its top clients.

Russia’s shrinking role in global arms exports has allowed France to overtake it as the world’s second-largest arms supplier between 2020 and 2024. France has exported weapons to 65 countries and has tripled its arms sales to European nations such as Greece, Croatia, and Ukraine. Notably, 6.5% of the total arms imported by NATO’s European countries now come from France.

Developments in Asia, the Middle East, and Africa

China has invested heavily in expanding its arms exports by developing its domestic military industry. However, it remains the fourth-largest global arms exporter, accounting for 5.9% of global arms sales. Political considerations have limited its expansion, as major importers tend to avoid purchasing Chinese weapons.

China’s arms imports also fell by 64% between 2020 and 2024, as the country increasingly relies on domestically produced weaponry. This shift has contributed to a decline in global arms transfers to the Asia-Oceania region, which dropped from 41% to 33%, though it remains the world’s largest arms-importing region.

India, the world’s second-largest arms importer—mainly sourcing weapons from Russia (36%)—continues to ramp up its military acquisitions due to perceived threats from China and Pakistan. Pakistan, in turn, has significantly increased its arms imports by 61% between 2020 and 2024 compared to the previous five years. China remains its dominant supplier, accounting for 81% of Pakistan’s arms imports.

The Middle East remains a highly volatile region, particularly due to Israel’s ongoing war in Gaza following Hamas’ attack on October 7, 2024. Despite the conflict, Israel’s arms imports remained stable between 2020 and 2024. The U.S. is Israel’s main arms supplier, providing 66% of its total imports, followed by Germany at 33%.

“Diplomatic ties between Israel, the U.S., and the EU remain strong, as does Israel’s role as a strategic partner in the arms industry,” notes Caramés. He stresses the importance of continuing to “speak out and condemn violations of arms embargoes against Israel, both in terms of imports and exports, as seen in cases like Spain.”

In West Africa, arms transfers have surged over the past 15 years due to worsening security conditions. Between 2010-2014 and 2020-2024, African states nearly doubled their arms imports, with an 82% increase. Nigeria was the region’s top importer, accounting for 34% of all arms acquisitions between 2020 and 2024. Meanwhile, arms imports in Sub-Saharan Africa rose by 4.2% during the same period.

Spain: The World’s Ninth-Largest Arms Exporter

The SIPRI report also highlights Spain, which ranks ninth globally in arms exports, holding a 3% share of the global market. Spain’s arms exports increased by 29% between 2020 and 2024 compared to the previous five-year period.

However, Caramés notes that Spain initially ranked as the world’s fifth-largest arms exporter at the start of this period but has gradually slipped down the rankings. By 2024, Spain had dropped to eleventh place.

“This isn’t necessarily a cause for celebration—it reflects the growing strength of competitors like China and France, which have outpaced Spain in the global arms market,” explains Caramés. He adds that it will be crucial to monitor how Spain is impacted by the EU’s €800 billion rearmament plan.

Regarding the destination of Spanish arms exports, Saudi Arabia remains the country’s most important market, accounting for 24% of Spain’s total arms exports, followed by Australia (18%) and Turkey (13%).

Add new comment