The Centre Dèlas, in collaboration with the FETS, identifies for the first time the insurance companies and pension funds that collaborate with the military armament sector.

The talk is always of how banking is a source of military funding of the State, but it's not the only one. Insurance companies and pension funds would also be funding large manufacturers of military weaponry. This is confirmed, for the first time, by the ‘Banking, insurers and pension funds finance the business of war in Spain’ report, carried out by the Centre Delàs d'Estudis per la Pau in collaboration with Finançament Ètic i Solidari (FETS).

Part of the ‘Armed Banking’ campaign, the Centre Delàs has published this new report which depicts the insurance companies and pension funds that also collaborate with the weaponry sector.

Banks act like investors of the arms companies’ shares, especially by loans, including the BBVA, Santander, ING, Deutsche Bank, Banc Sabadell, Bankia and CaixaBank. Between 2014 and 2019, financial institutions operating in Spain contributed 11,969 millions of euros to the military sector.

Now, Delàs confirms that twenty six insurers accumulate 19,767 millions of euros in weaponry funding. Cardiff Assurance, AXA, BBVA Seguros, Santander Seguros, Allianz, BancSabadell Seguros i Vida, VidaCaixa and SegurCaixa, Adeslas, AIG, Mapfre, Liberty Seguros and Línea Directa are some of these. Besides, there are ninteen pension plans from CaixaBank, BBVA, Ibercaja, Bankia, Banc Sabadell and Mutua Madrileña, among others, that have earmarked 30,354 millions of euros for the industry.

BBVA and Santander fund 62% of the Spanish banking total. If the SEPI (Sociedad Española de Participaciones Industriales) is added, the percentage goes up to 89%. According to a former report from the Centre Delàs, between 2013 and 2018 Spanish banks would have contributed more than 8,000 millions of euros to 39 military companies. BBVA and Santander would have consolidated 60% of this funding.

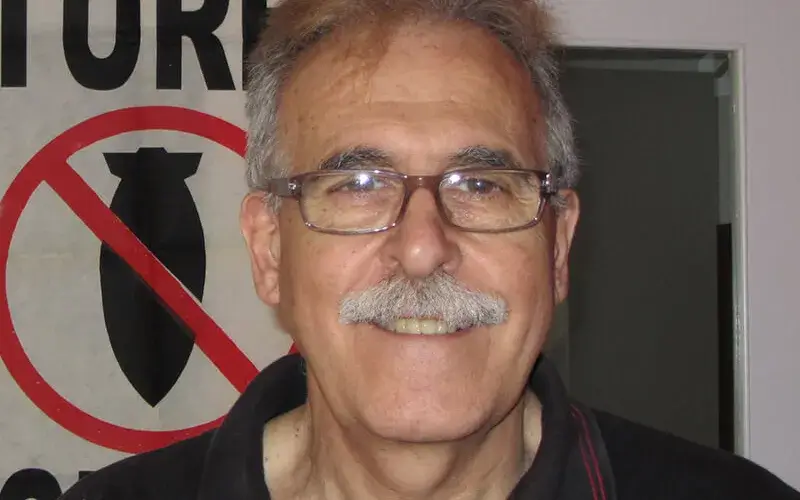

‘We are not just funding arms manufacturers with our bank accounts and our term deposits, but we are also contributing in a decisive way to the expansion of the armament sector by hiring any kind of insurances, such as life insurances, liability insurances or provision of services (like travel assistance) and pension plans’, says the Centre Delàs coordinator, member of the campaign and report author, Jordi Calvo.

The armament sector

75% of the production that buys the Ministry of Defence is provided by five military companies: Airbus, Navantia (SEPI), General Dynamics, Indra and Expal (Maxam), these last two being the main suppliers.

Indra is an enterprise engaged in the development of technological products and services for war missiles and aircrafts, among other border control and surveillance products; and Maxam, involved in ammunition, with a ‘clear commercial relationship with Saudi Arabia, one of the main weaponry clients in the world that leads the coalition in the war against Yemen’, would be the real stakes for the banking, according to the Delàs Centre.

Expal, affiliated to Maxam, engaged exclusively in the manufacturing and sales of arms, has been the main Spanish manufacturer of antipersonnel mines and cluster bombs until they were banned. Bombs, missiles, ammunition or artillery are the equipment sold in Colombia, Western Sahara, Central African Republic, Ghana, Turkey, Israel, Saudi Arabia or the United Arab Emirates. Delàs assures that the arms trade is ruled by political reasons, because Spain does not sell to Iran, Libanon, Palestine, Syria or Yemen.

In Catalunya there are the affiliates Nitricomax, in Tarragona, that produces nitric acid, and an ammunition dump in Bruc, which contains more than 200.000 kilos of explosives. It was this dynamite manufactured by Maxam the one used in the Atocha attacks in 2004, according to the National Police commissioner chief of the technicians in the deactivation of explosive devices, Juan Jesús Sánchez Manzano.

Indra, on the other hand, is part of the Ibex 35 and the enterprise that leads in Spain the FCAS (Future Combat Aerial System) construction, which is being carried out together by France, Germany and Spain.

Spain, exporter of weapons

Spain is the second European country that exports weapons to Turkey, and Saudi Arabia is consolidated as the main arms export client of the country. In December 2018 three military programmes worth more than 7,000 millions of euros were authorised to build tanks and frigates for the Eurofighter combat aircraft, the same that is used to bomb Yemen.

Despite the International Criminal Court’s and UN’s accusations against Spain, the 2007 Spanish law that does not allow selling armament that “can be used in actions that disrupt the peace, the stability or the security at a global or regional level” is still violated.

In addition to this, the 2014 Arms Trade Treaty of the UN, ratified by Spain, forbids the export of weapons for committing human rights violations to other countries. But the state government’s agreement, in force since 1987, rules the confidentiality of the authorisations for armament sales.

Ethical banks as an alternative

In order to escape from the traditional banking and the armament funding, there is the ethical banking, whose objectives is the compatibility between the economical profitability and human rights and environmental respect. Ethical banking only invests in added value projects for the society from a social, environmental, cultural and educational perspective.

According to FETS, the ethical bank has to comply with five principles: applied ethics, coherence, democratic participation, transparency and involvement. We can find nine options in Spain: FIARE (Responsible Savings Investment Foundation), Triodos Bank, Coop57, Enclau, IDEAS, IUNA, GAP-Madrid, Oikocredit and FIDEM (International Foundation for the Women Entrepreneurs).

‘There are ethical options for the insurance sector, even if they are still limited to some insurance brokers, there are new welfare institutions or insurers that comply with the ethical principles of the Ethsi seal.’ explains the Centre Delàs. This seal guarantees quality management of businesses certified in solidarity and sustainability.

'Armed Bank' campaign

Currently, there are nine organisations that participate in the campaign: Centre Delàs d’Estudis per la Pau, SETEM, Justícia i Pau, ODG, Col·lectiu Rets, AA-MOC, FETS, Fundació Novessendes and the Fundació Finanzas Éticas.

Their objective is to report any bonds between financial institutions and the armament industry to raise awareness in society about the relationship between these financial practices and human tragedies and international conflicts. They show the volume and importance of relationships between banks and arms companies in order to identify the responsible financial institutions of the manufacturing and exportation of weapons.

They identify five ways to fund the armaments industry: shareholding in weapon companies, financing arms exports, issuing bonds and promissory notes, savings and pension investment funds, and loans and credits for the military industry.

Add new comment